Planning a successful event depends on your event planning budget. It’s the roadmap that determines what you can do, how you do it, and where your resources go. According to a recent Global DMC Partners survey, 50% of event professionals said their budgets haven’t increased, even though prices for venues, catering, travel, and equipment are increasing.

So what does this mean for professionals managing sports tournaments, cultural festivals, large conferences, or entertainment events? It means budgeting smarter is essential.

Whether you’re working with a tight budget or managing a large-scale production, this guide will walk you through how to plan your event budget with clarity, control, and confidence, using tools and strategies that actually work.

TL;DR

A clear event planning budget helps you control costs, prioritize spending, and avoid surprises.

Break down your budget into fixed and variable costs, and account for all revenue sources.

Use a step-by-step approach, set goals, track cash flow, monitor spending, and review performance post-event.

Sample budget templates for in-person and hybrid events help guide real-world planning with estimated figures.

Understanding the Basics of an Event Budget

Before you plan the details of your event, you need a clear picture of how much you can spend and where the money will go. That’s where an event budget comes in. It’s a detailed plan that outlines all expected expenses and potential sources of income for your event, from venue and catering to staff, marketing, and logistics.

To build an effective budget, you need to understand four key elements.

Fixed costs

These are the non-negotiable expenses that stay the same no matter how many people attend your event. Examples include venue rental, licenses, insurance, and basic equipment rentals.

Variable costs

These depend on the number of attendees or the scale of the event. Catering, printed materials, transportation, and staffing are good examples. The more people you expect, the higher these costs may go.

Total income from the event

This includes all income sources tied to your event, such as ticket sales, sponsorships, exhibitor fees, and sometimes even merchandising or advertising. Estimating revenue accurately is key to balancing your budget.

Financial outcome of the event

Once you compare your total revenue to your total costs, you can calculate your expected profit or potential loss. This helps you assess whether the event is financially viable and where you might need to adjust.

Why setting a clear event budget matters?

A clear budget gives you direction, helps you make smart decisions, and keeps your entire team aligned. Below are key reasons why setting a budget is one of the most important steps in event planning.

1. Better financial control

When you outline your expected costs from the start, you stay in control of your spending. It helps prevent overspending and ensures you allocate funds where they’re most needed. Clear tracking also makes it easier to spot unnecessary expenses and adjust before they impact your overall budget.

2. Helps you set priorities

With a defined budget, it’s easier to focus on what matters most, like choosing the right venue or investing in strong guest experiences, without wasting money on extras that don’t add value. For example, if attendee experience is a priority, you can allocate more to engagement tools and entertainment, and cut back on things that aren’t essential.

3. Makes planning smoother

Once your budget is set, it becomes a practical tool that shapes every part of the planning process. It helps you decide what’s feasible, shortlist vendors based on cost, and schedule payments in a timely way. This structure keeps things moving and reduces guesswork during execution.

4. Makes communication easier

Budgets help when working with vendors, sponsors, and partners, too. When you share clear budget outlines, everyone understands what’s possible, which avoids confusion and saves time during negotiations, approvals, or cost discussions.

5. Let’s you measure results

Once the event is over, comparing your planned budget to the actual spending helps you see what went right and what needs improvement. This post-event review is key to learning, especially when you’re organizing recurring events. It helps you tighten future budgets and improve cost-efficiency.

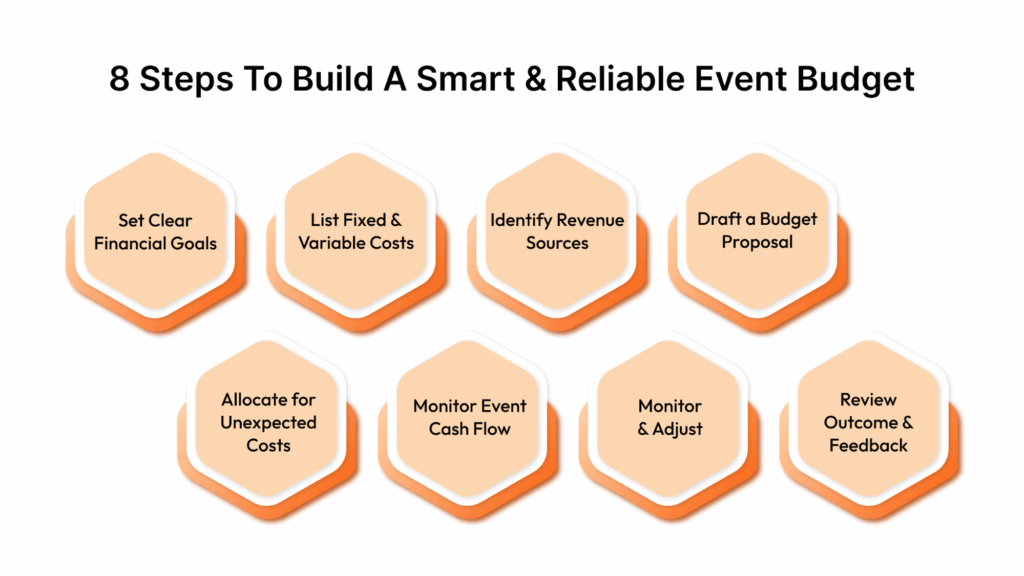

8 steps to build a smart and reliable event budget

Creating an accurate budget needs the right structure. Whether you’re planning a conference, cultural event, sports tournament, or a hybrid experience, breaking the process into simple steps helps you stay organized and financially confident.

Here’s how you can plan your event planning budget in eight clear steps.

Step 1: Set clear financial goals for your event

Before you start allocating funds, define what you want to achieve financially. Are you aiming to break even, turn a profit, or simply stay within a set budget? Defining your financial objectives early helps shape your spending plan and gives you a target to work toward.

For example, if you’re planning a three-day conference and aim for a 20% profit, you’ll need to balance your ticket pricing and sponsorship income against costs like venue, catering, and marketing.

Wiz‑Team’s Event‑Works platform helps set and track these financial goals from day one. You can define your revenue targets and monitor performance in real time to ensure your event stays financially on track.

Step 2: Outline your fixed and variable costs

Once you’ve set your financial goal, the next step is to understand where your money will be spent. Break your expenses into two main categories, fixed costs and variable costs, to get a clearer picture of your overall budget.

To budget more effectively, it helps to further organize these based on your event type.

In-Person Events

These come with a wide range of logistical costs. Common expenses include:

Venue fees and deposits

Catering and beverages

Event signage and branding materials

On-site staffing and security

Sanitation and safety equipment (especially for large crowds)

Virtual and Hybrid Events

These require strong digital infrastructure and support:

Webinar or streaming platforms

Technical support staff for live sessions

Licenses for collaboration tools

Digital attendee kits or e-gift cards

A/V Equipment Needs

Both in-person and hybrid events often rely on professional-grade audio and video gear:

Microphones, speakers, projectors, and LED walls

Simultaneous translation or captioning systems

Recording equipment for sessions or keynote addresses

Livestream and Video Production

Especially important for hybrid or fully virtual events:

Live camera crews

Editing teams for pre- and post-production

Livestream technicians to manage feeds across platforms

On-demand video hosting services

Step 3: Identify where your revenue will come from

A solid event budget is about knowing how you’ll fund them. Listing all possible revenue sources helps you estimate how much income your event can generate and whether you’ll need extra financial support.

Here are common revenue streams to consider.

Ticket Sales

If your event is paid or ticketed, this may be your primary income source. Estimate how many tickets you expect to sell and at what price points (early bird, VIP, group rates, etc.).

Sponsorships

Sponsors often contribute funds or services in exchange for visibility. Build different sponsorship tiers (e.g., gold, silver, bronze) and offer benefits like logo placement, booth space, or speaking slots.

Vendor or Exhibitor Fees

If your event includes a marketplace or exhibition, vendors pay to participate. You can charge based on booth size, location, or access to attendee data.

Grants and Institutional Support

Cultural and educational events may receive funding from governments, universities, or nonprofits. These can help cover costs without needing to raise ticket prices.

Merchandise Sales

Selling branded merchandise (like T-shirts, bags, or books) can be a useful add-on revenue stream, especially at festivals, sports events, and fan-driven gatherings.

Step 4: Draft a budget proposal

Once your cost and revenue estimates are ready, organize them into a simple, well-structured budget proposal. Break down expenses by category, such as venue, catering, technology, and marketing, and list all income sources like ticket sales, sponsor support, or exhibitor fees.

Along with the numbers, your proposal should also include:

The event’s main goals and purpose

Insights or results from past events you’ve organized

Cost and attendance benchmarks from similar events in your industry

A backup plan in case costs change unexpectedly

An estimate of where you might exceed your budget

How you plan to track and report the event’s return on investment (ROI)

Step 5: Set aside money for unexpected costs

Even well-planned events can run into last-minute issues, like renting extra equipment, extending venue hours, or covering unexpected technical support. To stay prepared, it’s smart to set aside 5–10% of your total budget as a safety net.

Example: If your event budget is $50,000, keeping $2,500 to $5,000 aside for unplanned expenses can help you manage surprises without cutting into essential areas.

Step 6: Track your event’s cash flow

Managing your cash flow is just as important as budgeting. You need to know when the money is coming in and going out. Poor timing can lead to cash gaps, even if your event is financially sound on paper.

To stay in control:

Monitor when ticket sales or sponsorship funds will be received

Track due dates for vendor payments, deposits, and service fees

Set reminders for milestone payments like venue instalments or catering balances

Keep an eye on refund policies and emergency payouts

Start by understanding your available funds:

Cash on Hand Before Expenses = Total Revenue minus Pending Payments You Haven’t Received Yet (such as outstanding invoices or sponsorship funds).

Final Cash on Hand = Cash on Hand Before Expenses minus Upcoming Bills or Vendor Payments

Step 7: Monitor and adjust as you go

A good budget should evolve with your event. As plans change, prices shift, or new income sources appear, your budget needs to reflect those updates.

Here’s what to do:

Review your budget weekly or biweekly during the planning phase

Update actual vs. projected costs as invoices come in or services are confirmed

Reallocate unused funds if certain areas come in under budget

Adjust for last-minute changes like added guests, extra services, or upgrades

Step 8: Review the final outcome and gather feedback

Once your event is over, take time to evaluate your financial performance. Compare what you planned to spend against what you actually spent, and see how well you met your revenue targets. This post-event review helps you measure success and identify areas for improvement.

Start with a simple review:

Look at budget vs. actual costs in each category

Check if you reached your financial goal (profit, break-even, or staying within budget)

Note where you overspent or came in under budget

Review revenue streams and see which performed well and which fell short

Also, collect feedback from your team, vendors, and attendees to understand what worked and what didn’t. These insights help you make smarter budgeting decisions for future events.

With Wiz‑Team’s Event‑Works, you can generate detailed post-event reports with clear financial summaries, making it easier to analyze outcomes, share results with your team, and use data to plan better for future events.

Sample event budgets and templates

Understanding how to structure your event budget becomes easier when you can see real examples. Below are simple examples and templates for both in-person and hybrid events to help guide your event planning budget.

Example 1: Budget for an In-Person event

You’re organizing a one-day corporate seminar for 100 attendees at a hotel venue. The event includes keynote speakers, networking sessions, lunch, and printed materials. The goal is to offer a professional learning and networking experience with minimal disruptions and a smooth attendee journey.

Here’s a table outlining how you might plan the budget for that event.

Category | Item | Estimated Cost (USD) |

Venue & Setup | Hotel conference room + seating setup | $4,500 |

Event decor and signage | $800 | |

Catering | Buffet lunch + beverages | $3,000 |

Coffee/snack station | $700 | |

Audio/Visual (A/V) | Projector, mics, and screen | $1,200 |

Technical support staff | $600 | |

Marketing | Email marketing tools | $300 |

Printed brochures & name tags | $400 | |

Staffing | Event coordinator + 2 assistants | $1,500 |

Miscellaneous | Contingency (10%) | $1,300 |

Total Estimated Cost |

| $14,300 |

Example 2: Budget for a Hybrid Event

You’re organizing a two-day product launch event with 150 in-person attendees and 500 virtual participants. The event includes live presentations, breakout sessions, and Q&A segments, both on-site and streamed online.

Below is a typical budget layout for such an event.

Category | Item | Estimated Cost (USD) |

Venue & Setup | Conference hall + staging | $6,000 |

| Signage and event branding | $1,000 |

Catering (In-Person) | Meals, snacks, and beverages | $4,500 |

A/V & Production | Cameras, mics, and lighting | $3,500 |

| Livestreaming tech and crew | $3,000 |

| On-demand content editing | $1,200 |

Virtual Platform | Streaming and interaction tools | $1,500 |

| Tech support for virtual guests | $800 |

Marketing | Digital ads and email campaigns | $1,200 |

| Event website and registration | $600 |

Staffing | On-site and remote coordinators | $2,000 |

Contingency | (10% buffer) | $2,030 |

Total Estimated Cost |

| $27,330 |

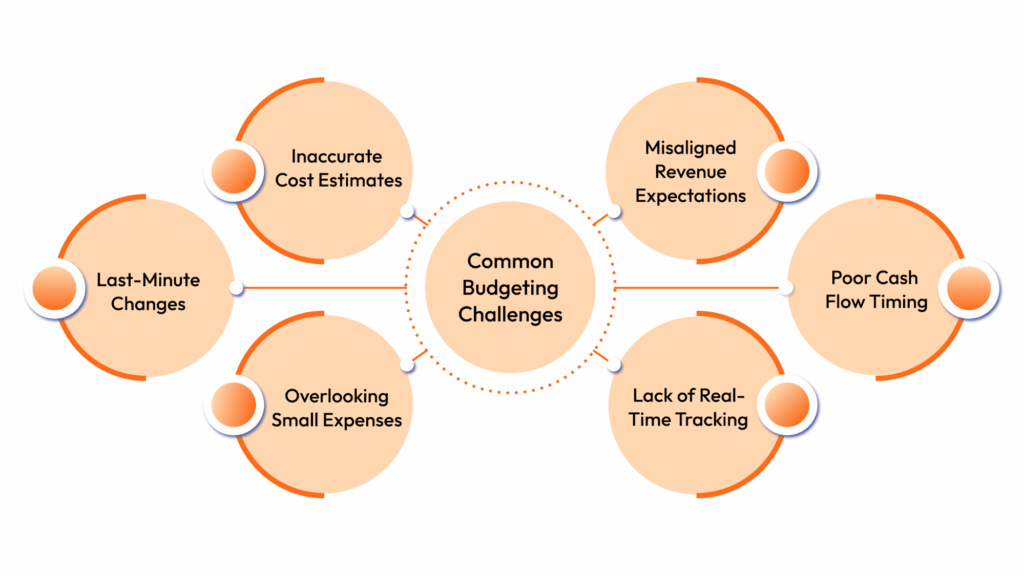

Common budgeting challenges in event planning

Creating an event budget involves constant adjustments, unexpected costs, and tough decisions. Even experienced planners face a few common hurdles while managing event finances.

1. Inaccurate cost estimates

Prices can fluctuate, and vendors may add hidden charges. Underestimating costs in early planning stages can lead to budget shortfalls later. For example, a venue quote may exclude setup, cleaning, or overtime charges, which only show up in the final invoice.

2. Last-Minute changes

From adding extra guests to unexpected venue needs, changes close to the event often raise costs. Without a buffer, even small updates can push you over budget. For example, needing extra chairs or extending A/V support by an hour can quickly increase expenses.

3. Overlooking small expenses

Items like printing, local transport, or payment processing fees seem minor, but add up fast. Ignoring these can throw your budget off balance. Keep a checklist of commonly missed expenses to avoid surprises.

4. Misaligned revenue expectations

Overestimating ticket sales or sponsorships can leave you short on funds. It’s important to stay realistic and back revenue projections with data or past results. For example, assuming 500 ticket sales when only 350 register can leave you with a large budget gap.

5. Poor cash flow timing

You might have the funds, but if payments aren’t timed well, like deposits due before revenue arrives, it can strain your resources mid-planning. For example, a $10,000 venue deposit might be due weeks before your first sponsor payment comes in.

6. Lack of Real-Time tracking

Without tools to monitor actual vs. planned spending, it’s easy to lose control. Manual tracking often leads to outdated or incomplete financial data.

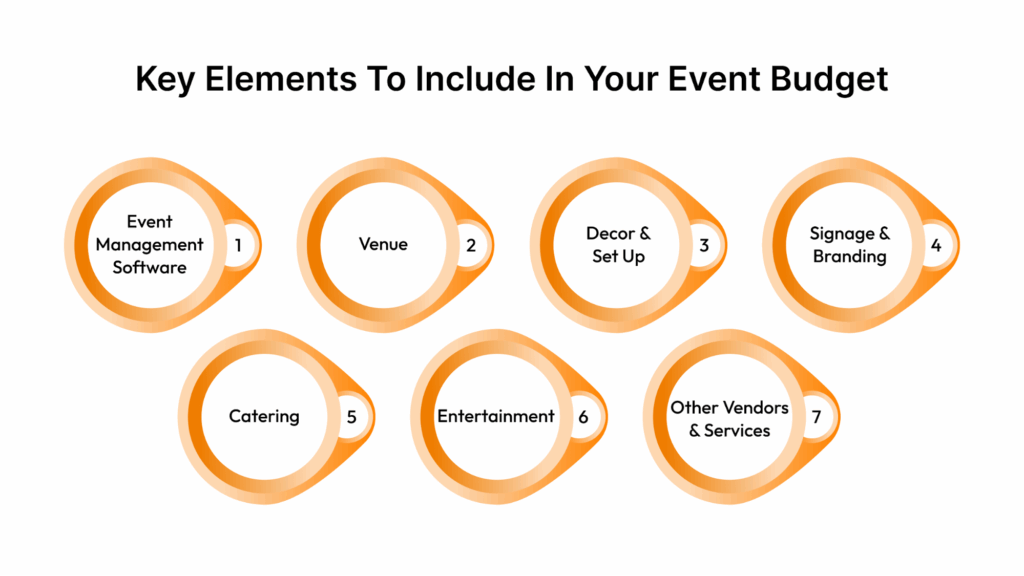

Key elements to include in your event budget

To create a realistic and effective event budget, it’s important to account for every major cost area from the start. Listed below are the core elements you should factor in.

1. Event Management Software

Investing in the right platform helps you manage registrations, schedules, communications, and finances in one place. With the right tool, you can manage everything from guest registrations, session scheduling, accommodation tracking, and communication to budgeting and post-event reporting, all in one place.

Wiz‑Team’s Event‑Works platform gives you the flexibility to customize workflows based on your event type and size. It also lets you automate confirmations, generate reports, and integrate with third-party systems like payment gateways and access control tools, saving time and reducing errors.

2. Venue

Choosing the right venue is crucial for staying within budget. Here’s what to include when estimating venue-related costs.

Type of Venue: Hotel conference rooms, outdoor spaces, banquet halls, sports arenas, or auditoriums, each comes with its own pricing structure and service level.

Rental Duration: Costs may vary based on whether you’re booking by the hour, half-day, or full day. Always check if setup and teardown time are included or charged separately.

Capacity & Layout Needs: Ensure the space suits your expected headcount and technical requirements (e.g., stage setup, breakout rooms, networking areas).

Included Amenities: Some venues provide basic furniture, in-house A/V, or on-site coordinators; others charge separately for each.

3. Decor and Set Up

How your event looks and feels plays a big role in shaping the guest experience. Whether you’re aiming for formal, fun, or branded, decor brings your vision to life and needs to be budgeted early on.

Here’s what to consider:

Furniture Rental: Tables, chairs, sofas, bar counters, or lounge setups, especially for events where the venue doesn’t provide them.

Lighting Design: Mood lighting, stage lights, uplighting, or LED effects can transform even basic spaces and are essential for evening events.

Floral Arrangements & Greenery: From simple table centerpieces to elaborate stage florals, costs can vary based on the scale and flower types used.

Stage & Backdrop Setup: Branded backdrops, LED walls, or custom-built installations for speakers and performances.

Themed Elements or Props: These could include custom signage, photo booths, arches, or decorative installations to match a theme or brand identity.

4. Signage and Branding

From the entrance to the stage, well-placed and well-designed visuals can make your event feel polished and professional.

Here’s what to budget for.

Welcome Banners & Entrance Signage: Helps guests feel immediately oriented and sets the tone right from check-in.

Directional Signs & Floor Maps: Crucial for guiding attendees to sessions, restrooms, food areas, and exits, especially in larger venues.

Name Badges & Lanyards: These double as ID and mini branding opportunities. Include design, printing, and holders.

Booth or Stall Signage: For expos or networking events, ensure sponsors or vendors have branded setups that align with your theme.

Digital Signage: Screens showing schedules, speaker bios, sponsor messages, or live updates throughout the venue.

5. Catering

Food and beverages are a major part of any event experience and often one of the largest expenses. Whether you’re hosting a short seminar or a full-day conference, planning your catering budget carefully helps ensure guest satisfaction without overspending.

Here’s what to consider:

Meal Type & Service Style: Choose between plated meals, buffets, or boxed lunches. Buffets may offer variety, while plated meals feel more formal and cost more per guest.

Guest Count: Budget based on the number of attendees, with extra allowance for crew, speakers, and last-minute walk-ins.

Beverage Options: Include costs for water, tea, coffee, juices, or alcoholic drinks if applicable. Consider drink stations, bartenders, or self-serve setups.

Dietary Requirements: Include vegetarian, vegan, gluten-free, or allergen-specific options. Custom menus may come at a higher price.

Service Staff & Equipment: Don’t forget to factor in servers, bartenders, setup crew, and rentals like cutlery, glassware, and chafing dishes.

6. Entertainment

Bringing in the right talent can elevate your event, whether it’s a keynote speaker, industry expert, celebrity guest, or live performer. But quality comes at a cost, and these expenses need to be planned early.

Here’s what to include in your budget:

Honorariums or Appearance Fees: Most speakers and performers charge a fee based on their experience, popularity, and event type.

Travel and Accommodation: Flights, local transport, hotel stays, and per diems for meals and incidentals should be factored in, especially for out-of-town guests.

Technical Requirements: Some talent may request special equipment (e.g., wireless mic, AV setup, stage lighting). Make sure these are included in both AV and talent budgets.

Licensing and Performance Rights: If you’re hosting a musical act or using copyrighted material, include fees for usage rights or licenses.

Meet-and-Greet or VIP Sessions

If influencers or speakers are involved in extra sessions, budget for the added time and coordination needs.

7. Other Vendors and Services

Beyond the major categories, there are several other services that support your event behind the scenes. They’re essential to keeping things running smoothly.

Here’s what to include:

Security Services: For crowd control, entry checkpoints, bag checks, and overall safety. Especially important for large, high-profile, or ticketed events.

Photography and Videography: Hiring professionals to capture the event for marketing, social media, or future promotions. Don’t forget editing and post-production costs.

Transportation and Logistics: Includes shuttle services for guests, transport for crew, or freight for event materials and equipment.

Cleaning and Sanitation: Essential for venues with high footfall. Some events may also need restroom attendants, waste disposal, or extra sanitization stations.

Permits and Insurance: Required for certain venues or public spaces. Budget for event insurance, fire permits, or alcohol service licenses if needed.

Wi-Fi and IT Support: For check-in systems, livestreams, or exhibitor booths. Many venues charge extra for high-speed or dedicated connections.

Conclusion

Event planning always comes with moving parts, but your budget is what holds it all together. From setting clear financial goals to tracking every expense, a detailed budget ensures you stay in control and avoid surprises. It helps you make informed choices, allocate resources wisely, and measure the return on your efforts once the event is over.

Using a tool like Wiz‑Team’s Event‑Works simplifies the entire budgeting process. It gives you real-time visibility, accurate tracking, and everything you need to manage complex logistics. With the right plan and platform, you’re setting your event up for success.

Ready to take control of your event planning budget? Try Wiz‑Team’s Event‑Works to streamline your planning, track expenses in real time, and deliver events that stay on budget and on point.

FAQS

How do I create an event budget?

To create an event budget, list all potential expenses, categorize them, estimate costs for each category, and compare against your expected revenue to ensure you stay within financial limits.

What are the common expenses in event planning?

Common expenses include venue rental, catering, audio-visual equipment, decorations, permits, insurance, and marketing costs.

What is the budget for an event plan?

An event budget is a detailed estimate of all the costs and income tied to an event. It covers venue fees, catering, decor, staffing, equipment, and more, helping you manage resources effectively and avoid overspending.

How to calculate an event budget?

Start by outlining your event goals, then list all fixed and variable expenses. Estimate revenue sources like ticket sales or sponsorships. Subtract total costs from expected income to understand your financial position.

How can I save money on my event budget?

You can save money by negotiating with vendors, choosing off-peak dates, utilizing volunteers, and leveraging sponsorships or partnerships.

What is the importance of contingency planning in event budgeting?

Contingency planning is crucial as it prepares for unexpected costs, ensuring that you have a financial buffer to handle emergencies without derailing the event.

#WizJourney